What clients say

APPROVE's Impact

"First month Warrior Equipment has been teamed up with

APPROVE Financing and this partnership has been nothing

short of GREAT! Their ability to work deals in an

efficient and effective manner for both the end consumer

and Warrior Equipment has been outstanding. The

communication has been easy and timely. We look forward

to what the future will bring with APPROVE Financing!"

Ray James,

Business DevelopmentWarrior

Equipment

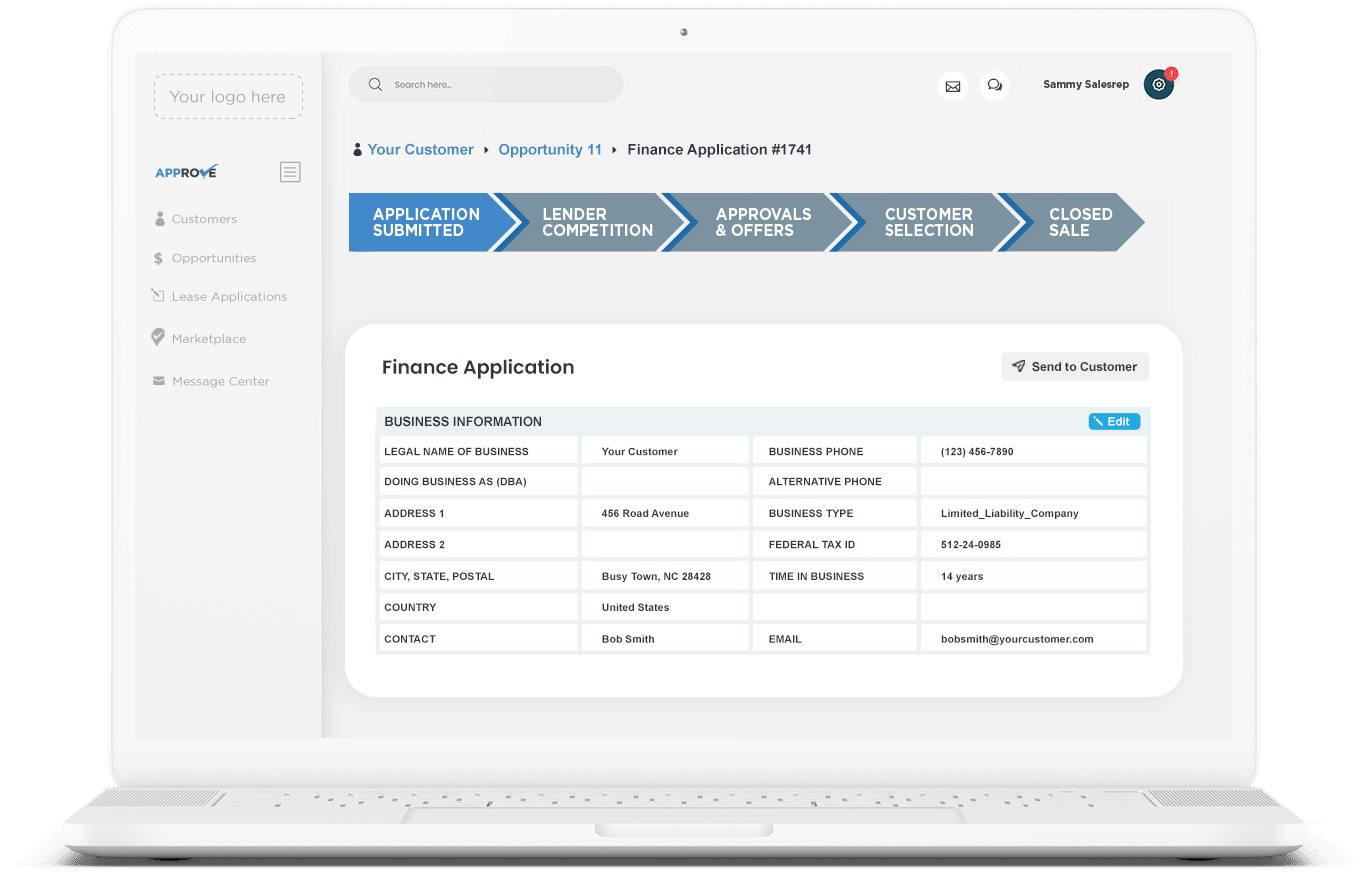

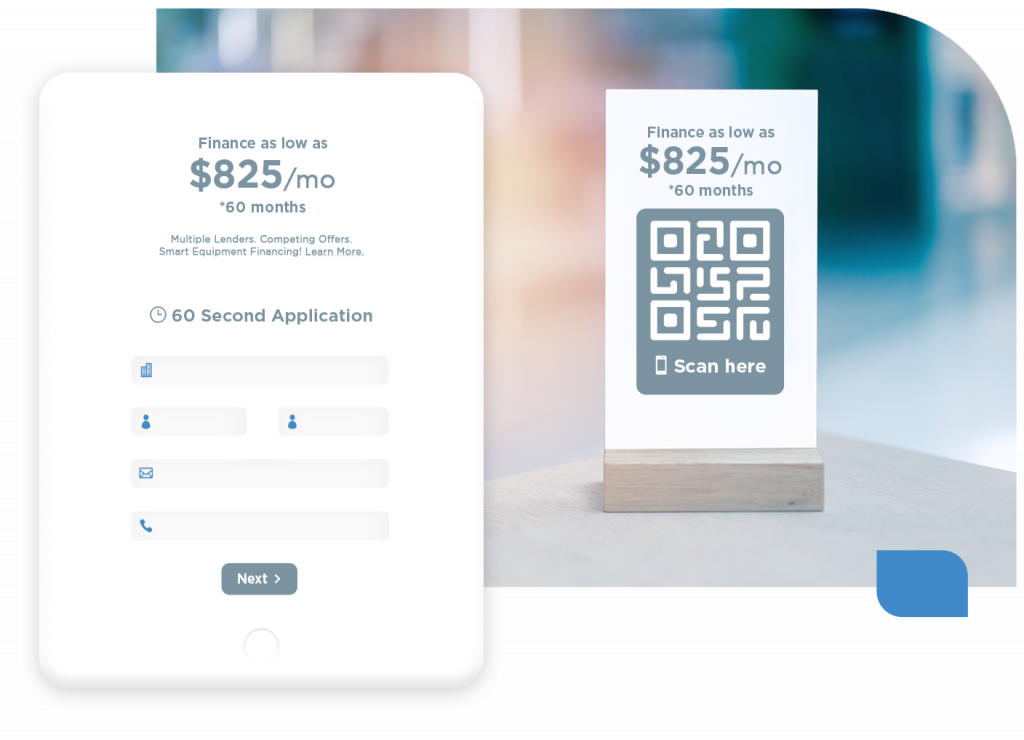

"Approve has become a great resource for our team. It

has allowed us to provide our clients with more options

and enabled our team to close more deals. We’ll continue

to use Approve to take care of our customers because

it’s such an easy tool for everyone on our team to

access!"

Greg Dunn,

Digital Marketing SpecialistAdvanced

Geodetic Surveys, Inc.

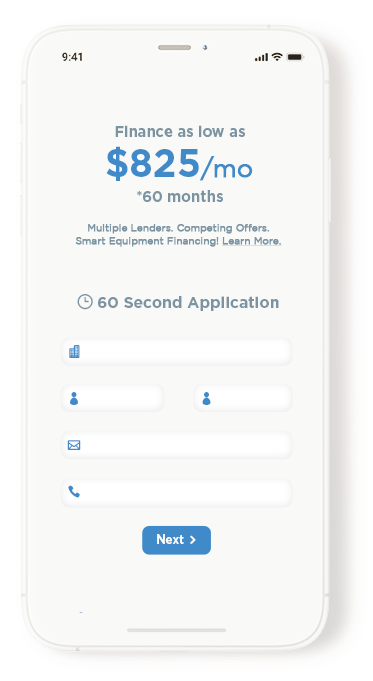

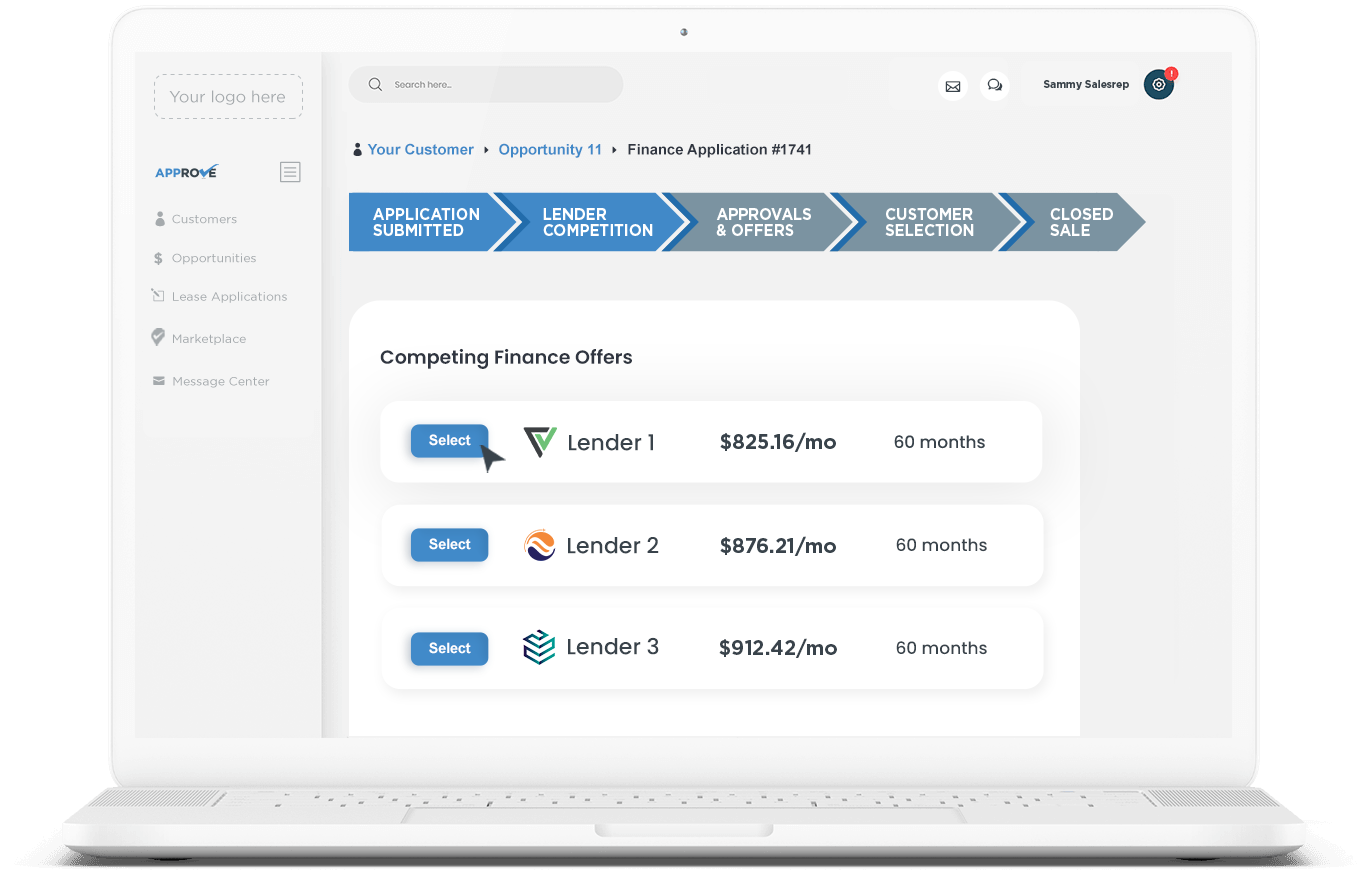

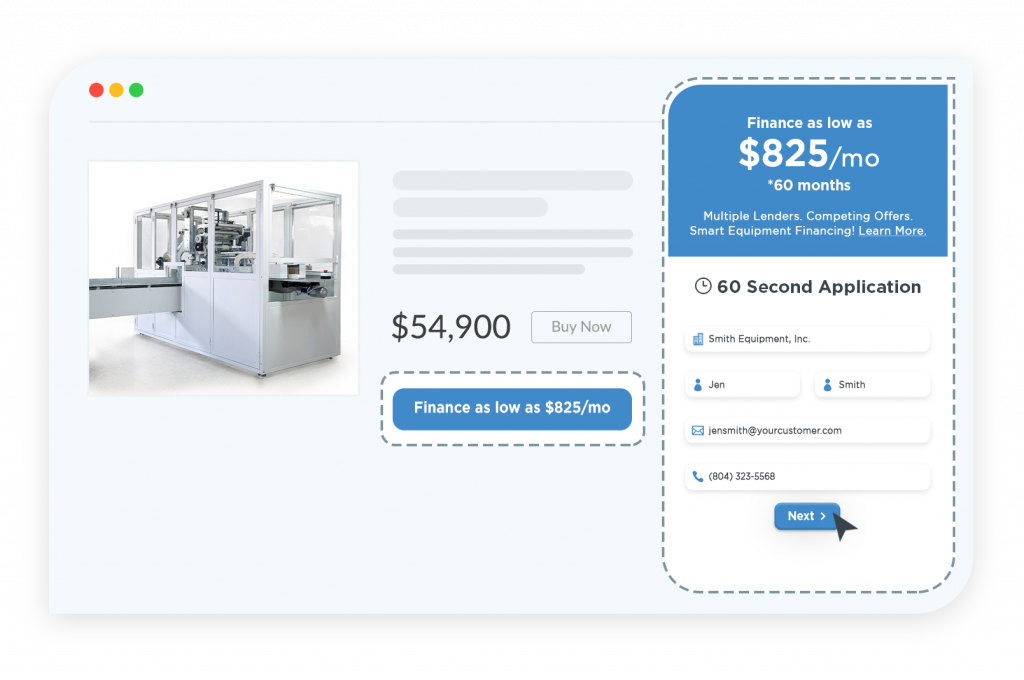

"APPROVE allowed us to meet our customers on their

terms, by offering financing directly on our site. Our

end users now have multiple financing options at their

fingertips, and can make informed decisions for their

business."

Connie Hardy,

VP of MarketingNational

Flooring Equipment